PPG Tax and McDonald Law Firm secured a decisive jury trial victory our client’s Class A+ multifamily property in Plano, TX. The case tested CCAD’s willingness to defend flawed valuations at trial and underscored the financial risk appraisal districts face when they reject fair settlement offers.

PHH Wins Bexar County Jury Trial

PHH, represented by PPG Tax and McDonald Law Firm, secures a major jury victory against Bexar CAD in a high-stakes trial over Oro Stone Oak multifamily property in San Antonio—successfully rendering purchase price evidence irrelevant to the verdict.

Property Tax Reform – April 2025

PPG Tax and McDonald Law Firm have secured a landmark jury verdict for Barvin, owner of the Soap Factory Apartments in San Antonio, Texas. This case marks the first commercial property tax jury trial in Texas following the Texas Supreme Court’s Texas Disposal decision, a ruling that has fundamentally reshaped how property tax appeals are defended by appraisal districts.

Groundbreaking Jury Verdict for Barvin

PPG Tax and McDonald Law Firm have secured a landmark jury verdict for Barvin, owner of the Soap Factory Apartments in San Antonio, Texas. This case marks the first commercial property tax jury trial in Texas following the Texas Supreme Court’s Texas Disposal decision, a ruling that has fundamentally reshaped how property tax appeals are defended by appraisal districts.

Never Wait for Another Property Tax Refund… If Your Lender Will Let You

Texas property owners are often left with little choice but to pay tax liabilities in full, wait for litigation, then receive a property tax refund on their overpayment. Now there may be a better way.

Property Tax Protest Uncertainty Amid Recent Shutdowns

Most appraisal districts have yet to define exactly how property tax protests will look in their county. Does your current strategy go beyond the initial ARB?

Are you betting on Bigfoot? The 3 myths of property tax consulting eroding your NOI.

Is your consultant selling an unproven strategy? Here are the three most-prevalent, and most ineffective myths of property tax consulting.

Is your Property Tax Attorney a Paper-Pusher or Bulldog?

Not all property tax attorneys are created the same. Ask yourself these three questions to help shed light on the type of attorney you are dealing with.

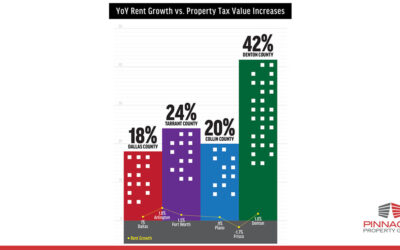

Disparity swells between slowing rent growth and increasing property tax assessments

See how Pinnacle Property Group recently assisted an Austin-based multifamily investor in receiving a valuation at 79% of recent purchase price.

Multifamily Sector Outlook Remains Steady in Early 2018

While the start of 2018 remains strong, rumors of market corrections persist. Is now the time to consider strategic but sensible capital improvements?