Carmel Creek

We helped Commerce Capital Partners achieve a $7.6M value reduction and $209.8K in tax savings for their Houston, TX multifamily property Carmel Creek.

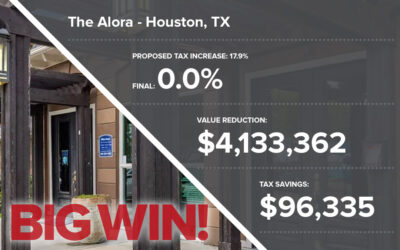

The Alora

Big or small, we keep Texas property values in check. See our success with The Alora in Houston, where we cut $4.1M off their value.

AMLI 2121

AMLI Residential achieved a $28.4M value reduction and $682.6K in tax savings for their AMLI 2121 Houston, TX multifamily property.

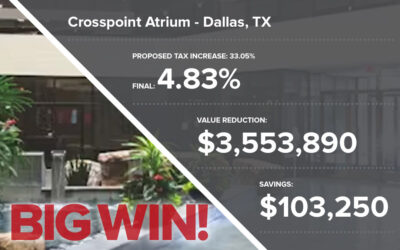

Crosspoint Atrium

SkyWalker Property Partners secured a $3.6M value reduction and $103.3K in tax savings for their Dallas, TX office property Crosspoint Atrium.

Stassney Heights

We secured a $3.8M value reduction and $80.9K in tax savings for Longpoint Realty Partners’ Austin, TX retail property Stassney Heights.

Watermarke

We gained a $6.3M value reduction and $183.6K in tax savings for Commerce Capital Partners’s multifamily property Watermarke in Fort Worth, TX.

ARIUM Towne Lake

We achived a $10.5M value reduction and $328.4K in tax savings for CARROLL Organization’s Houston multifamily property ARIUM Towne Lake.

Courtney Manor

Big win for Cottonwood Residential with a $10.1M value reduction and $202.2K in tax savings for their Plano, TX multifamily property.

Parkside So7

Tabani Group secured a $22.1M value reduction and $584.9K in tax savings for their Fort Worth, TX mixed-use property Parkside So7.

Never Wait for Another Property Tax Refund… If Your Lender Will Let You

Texas property owners are often left with little choice but to pay tax liabilities in full, wait for litigation, then receive a property tax refund on their overpayment. Now there may be a better way.